Corporate Tax Planning Methods

페이지 정보

본문

It is worth contemplating making these purchases at the close of the tax yr to capitalize on depreciation deductions and different related tax incentives that permit immediate expensing or accelerated depreciation. This strategy can facilitate tax savings by augmenting non-money deductions and diminishing the tax burden for small businesses. 4. Timing the payment of bonuses and compensation: If what you are promoting provides bonuses or different types of compensation to staff, timing the cost of those quantities can influence tax legal responsibility. Efficient aircraft lease administration is essential for airlines to operate efficiently and profitably. It requires an intensive understanding of the regulatory framework and efficient risk management strategies. There are various forms of aircraft leases, every with its own advantages and disadvantages. By rigorously selecting the correct leasing options, airlines can cut back their capital expenditure while nonetheless maintaining a modern and dependable fleet. Leasing corporations additionally benefit from this association by having a gentle stream of revenue from lease funds.

By including again rent expense and calculating EBITDAR, the 2 companies can be extra easily compared. Another vital point to deliver up is that IFRS permits firms to acknowledge interest expense on the cash circulation statement in either operating actions or financing activities. US GAAP requires that interest expense be considered an working activity.

The first aim of corporate tax planning is to reinforce a company’s profitability by minimizing its tax expenses legally. Varied methods could be employed to realize efficient corporate tax planning. Switch pricing entails setting prices for transactions between related entities inside a multinational corporation. By adjusting these prices, companies can allocate extra income to low-tax jurisdictions and reduce their general tax burden. The goal is to attenuate tax liabilities by the strategic use of credit, exemptions, and deductions. Permissive Tax Planning: On this approach, companies take advantage of the tax exemptions, incentives, and allowances granted by the legislation. It includes using authorized provisions within tax laws to reduce tax burdens with out resorting to aggressive techniques. Aggressive Tax Planning: This involves exploiting legal loopholes or ambiguities in tax laws to reduce tax funds. Whereas it may comply with the regulation, it might typically cross ethical boundaries, involving complicated structures or offshore transactions geared toward tax avoidance. Brief-term Tax Planning: Quick-time period tax planning is about discovering rapid tax-saving alternatives for the current or subsequent tax 12 months.

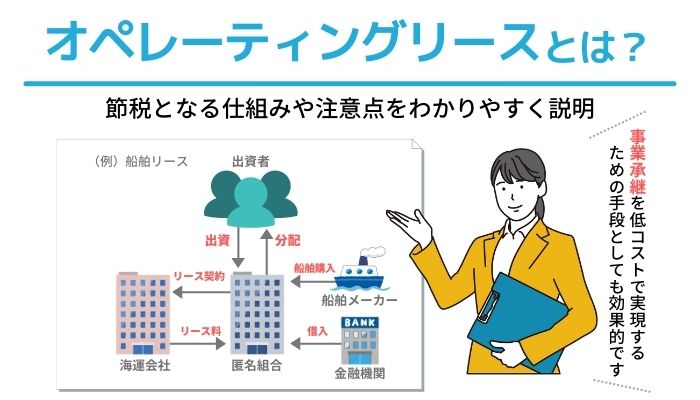

Situations will be adjusted to accommodate funding constraints, undertaking timelines, or gear lifecycles. 2. Capital Preservation: By avoiding the significant down funds typically wanted when buying items, leasing allows enterprises to save their cash. This ensures that cash might be obtainable for investments or other enterprise endeavours. Three. Entry to Reducing-Edge Expertise: オペレーティングリース リスク By removing the obligations linked with possession, leasing gives entry to the latest equipment and technology. This eliminates the necessity for ongoing capital investments and allows enterprises to use slicing-edge machinery and technologies to stay competitive. As well as, an individual’s excess business losses are topic to overall limitations. There may be steps that cross-via homeowners can take before the top of 2022 to maximise their loss deductions. Beneath present rules, the abandonment or worthlessness of a partnership curiosity might generate an strange deduction (as an alternative of a capital loss) in circumstances where no partnership liabilities are allocated to the curiosity.

- 이전글Aplikasi Kasir Terbaik Di Indonesia Untuk Segala Jenis Usaha!- YAZCORP.id 24.12.27

- 다음글Demo Slot Big Bass Bonanza Megaways Rupiah 24.12.27

댓글목록

등록된 댓글이 없습니다.